Table of Contents

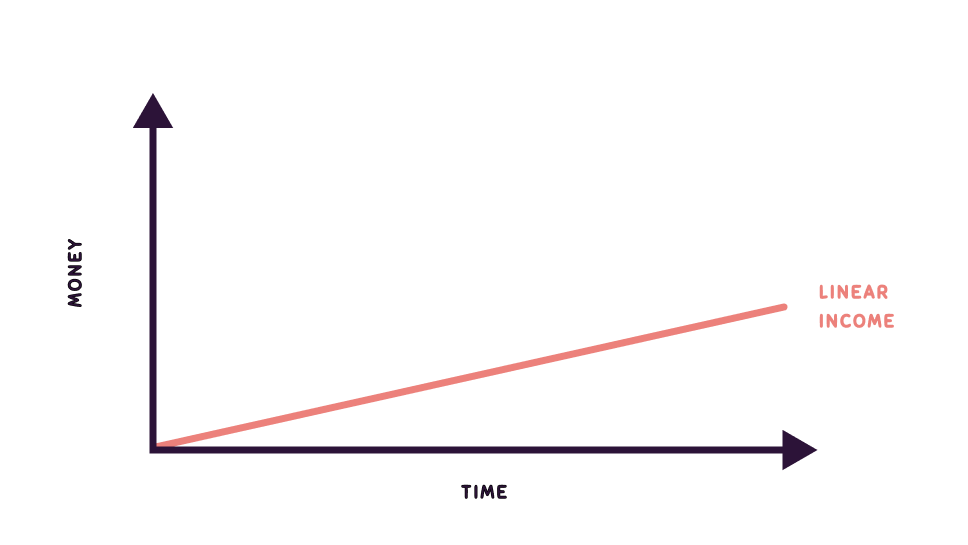

Most people spend their entire life generating linear income.

This is where there’s a direct relationship between the number of hours we work and the income we generate. So, if we’re employed, we’re most likely generating linear income because we’re trading our time for money.

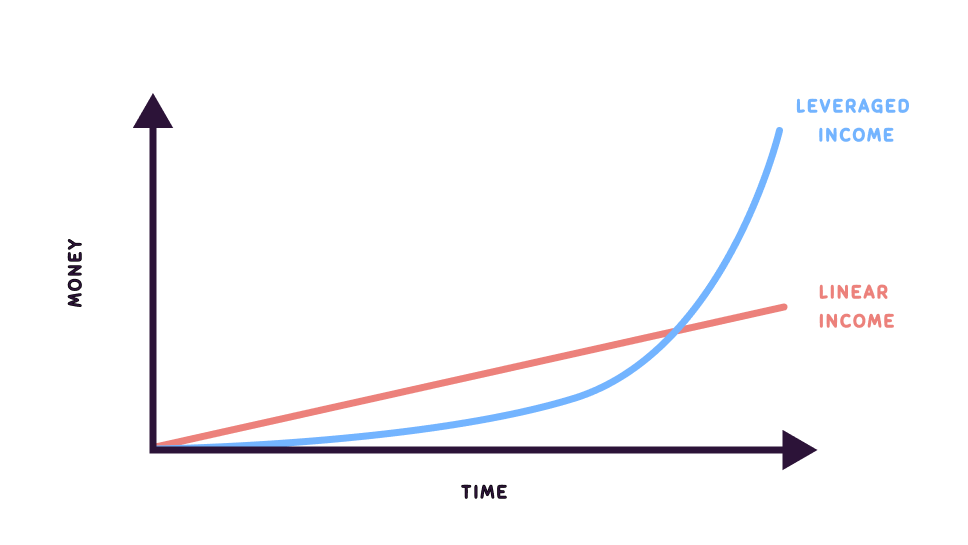

Wealthy people, on the other hand, generate something called ‘leveraged income’.

This is where the amount of time we spend working is not directly related to the amount of money we earn. Instead, our income is multiplied by leveraging certain resources – such as people, systems, investments, or whatever it may be – and then letting those things work for us without us having to do much.

And so this is what most people mean when they talk about ‘passive income’.

💰 What is Passive Income?

But, the truth is, a fully passive income doesn’t really exist.

There’s no magic income generating machine that you can build, press a big green on button, and then the money starts rolling in.

For example, even if you write a book or build an app, the work has often just begun. You still need to market the thing or maintain it in some way. And that’s assuming you did the initial research to determine if what you’re creating has genuine value and market fit.

But, having said that, there are a bunch of ways we can optimise our income streams to make them as passive as possible, all of which have varying levels of difficulty.

So, let’s look at the 5 core ways to make money online passively and how difficult each of them are to set up & run using my Passive Income Evaluation Framework, which looks at:

- The time investment: how much time does the passive income stream require initially?

- The financial investment: how much initial or ongoing capital does this passive income stream require?

- The ease of Earning: how easy is it to make $100 per month from this passive income stream? – which, for most people, would be a pretty decent starting milestone to reach.

💵 Investing

The first passive income stream, is investing, which is probably the easiest way for anyone to start earning passive income. (Disclaimer: I’m not a financial advisor).

Obviously this is a pretty broad topic, and I’ll probably create an entirely separate article on this at some point, so let’s just focus on stocks & shares for now.

Stocks and Shares

Investing in stocks and shares is one of the most traditional ways to build wealth and earn passive income.

By purchasing stock, you’re really just buying a small piece of a company. If the company grows and becomes more valuable, so does your share of it. So, if you eventually decide to sell your shares, then you’ve made a capital gain.

A common piece of advice for new investors is to invest in something known as an index fund, which is essentially just a type of investment that tracks a specific group of stocks, like the S&P 500, which measures the stock performance of 500 large US companies like Facebook, Apple, and so on.

So when you invest in an index fund, you’re essentially buying a tiny piece of many different companies at once, which spreads out your risk as one company’s poor performance isn’t going to have a big impact on your overall investment.

Plus, these sorts of investments have also had historically reliable returns over the long term, so if you’re looking to grow your wealth steadily without much need for constant monitoring or trading, then investing in index funds is the way to go.

Dividend Investing

One thing worth noting is that sometimes when you invest in a stock, it will pay something known as a dividend.

In short, dividends are portions of a company’s earning that are paid out to shareholders, typically on a quarterly basis. So, if you own shares in a dividend-paying company, then you’ll also receive a small amount of money regularly, simply for holding the stock.

For example, if a company issues a dividend of $1 per share and you own 100 shares, you would receive $100 every time the company pays out dividends.

1 The Time Investment

Rating: ★ ☆ ☆ ☆ ☆

Investing doesn’t take that much time to start.

All you need to do is to sign up to something like Wealthify or Freetrade if you’re in the UK or Webull if you’re in the US and you can pretty much start investing in index funds straight away.

Plus, you can often set things up so your investments are automatically managed, meaning you can be as hands-off as you like.

2 The Financial Investment

Rating: ★ ☆ ☆ ☆ ☆

When it comes to the money, investing in index funds and dividend stocks does require some upfront and ongoing capital, but it’s really up to you how much you put in.

You can start with as little as 50 to 100 dollars, depending on the platform and the fund. So it’s super accessible for most people.

3 Ease of Earning $100/Month

Rating: ★ ★ ★ ☆ ☆

Earning $100 per month from index funds and dividends is very achievable, but it largely depends on the size of your investment and the market conditions.

For example, if you’re targeting a typical annual return of 7% from your investment, you would need a fair amount of money invested – about $17,000 – to reach $100 in monthly income, or $1200 in annual income straight away.

So, the difficulty of making $100 per month depends on how hard it is for you to begin investing 5, 10, 15 thousand dollars into the stock market.

📸 Creator

The second passive income stream is being a content creator, like a YouTuber, podcaster, or blogger.

A lot of people think that only a tiny percent of lucky people can make any meaningful amount of money from creating content. But, that’s not entirely true.

If you create content that genuinely provides value and pick a niche that you are passionate about, you can attract a pretty dedicated following quite quickly, which is going to eventually generate some fairly decent passive income regardless of the type of content you decide to make.

For example, even my YouTube channel, which really isn’t that big in the grand scheme of things, is generating around $60 per month with around 10,000 subscribers. And I know plenty of other creators who are earning far more than me with far fewer followers. So, it’s definitely a very viable way to earn passive income once the content is created.

And this will just compound over time because content you made months or years ago will continue generating revenue long after you created it.

1 The Time Investment

Rating: ★ ☆ ☆ ☆ ☆

So, how much time does it take to kickstart this passive income stream?

Well, to actually start creating content online, it really isn’t difficult at all. For example, you could set up an account on YouTube in 5 minutes, record a video using your phone, and upload it straight away.

2 The Financial Investment

Rating: ★ ☆ ☆ ☆ ☆

You also don’t need to spend much money, if anything, to get this going.

Sure, you could buy the latest equipment and watch a bunch of courses on becoming a better creator, but you really don’t have to. You just need a laptop or even just a phone to get started a lot of the time.

In fact, I’d go as far as saying that it’s better not to invest too much money initially, because you’ll learn far more about what works and what doesn’t and what you find enjoyable by just starting with what you have.

3 Ease of Earning $100/Month

Rating: ★ ★ ★ ★ ☆

But, while starting is pretty pain free, it does take quite a bit of effort to reach $100/month.

For example, if you were to start a YouTube channel, you’d need to have at least 1000 subscribers plus 4000 hours of watch time in the last 12 months before you’re able to even begin earning any money on the platform.

For instance, it took me 26 videos and 18 months to get to this point.

And then, if we take an average RPM of about $2, which is our revenue per 1000 views, we’d need around 50,000 views a month to earn $100, which I still haven’t achieved.

This might sound manageable, but achieving this number of views requires not just consistent content but also engaging and high-quality videos that can attract and retain viewers, which is actually surprisingly hard.

📱 Digital Products

The next passive income stream involves building and selling digital products, like online courses, ebooks, wallpapers, website themes and other ‘downloadables’.

One example, is an ebook I created for my website Digestible Notes a few years ago. It took me about a day to put together and I now make about $100 per month from it without having to do anything.

Another thing you could do is build a course and market it on something like Udemy or Skillshare. As part of my day job building products for some of the world’s biggest creators I built a few courses for a big creator on Skillshare, and helped them make over $50,000/month some months, so it can be super profitable.

But there’s genuinely so many different types of products you could make.

I know a dude who made $100,000 in a week by selling a $28 icon set, another person who’s made almost $1 million selling website themes, and someone else who makes half a million dollars every year selling Notion templates. All of which were digital products they built once, and then sold almost entirely passively after that.

1 The Time Investment

Rating: ★ ★ ★ ☆ ☆

So, the time commitment for digital products can vary depending on the product and your existing skills. Simple products like ebooks might only take a few days to create, but more complex products, like courses or website themes, could take a lot longer.

But, the great thing is that once the product is created, they require very little time to maintain and you can just automate sales using a platform like Shopify or WooCommerce.

So, I’d give this a rating of 3/5.

2 The Financial Investment

Rating: ★ ★ ☆ ☆ ☆

Another great thing about digital products is that there are pretty much zero overheads.

Since you’re selling digital goods, there’s no need for physical storage, inventory management, or shipping logistics, which are often significant costs in traditional businesses.

Sure, you might spend some money on the initial tools and software to create the product and perhaps a hosting fee if you manage your own sales platform, but beyond that you really don’t have to spend much.

3 Ease of Earning $100/Month

Rating: ★ ★ ★ ☆ ☆

Finally, some people do find it relatively easy to earn $100/month if they’re leveraging existing platforms like Udemy, Etsy or Gumroad to sell their product.

But, the truth is that creating products that stand out in a saturated market can be very challenging. It requires a good degree of creativity, marketing savvy and originality, so it certainly isn’t the simplest thing to do either.

🎙️ Affiliate income

The penultimate passive income stream is affiliate income.

This is where you promote other companies’ products or services and earn a commission on the sales generated from your referrals.

For example, Amazon has an affiliate scheme where you can link to any of their products, and if someone clicks through your link and makes a purchase, you earn a percentage of that sale.

And, apparently, 35% of affiliates earn $35,000+ a year, so it can be pretty lucrative if enough people are clicking on your links.

1 The Time Investment

Rating: ★ ★ ☆ ☆ ☆

The great thing about earning affiliate income is that it’s incredibly simple to get going.

There are thousands of big companies that have some sort of affiliate scheme, including Amazon, Shopify and Target. And there are also websites like impact.com where you can see a bunch of different affiliate schemes that you can easily sign up for.

2 The Financial Investment

Rating: ★ ☆ ☆ ☆ ☆

There’s also zero upfront investment.

You don’t need to create a product or stock inventory; instead, you’re leveraging the products and services of established companies. This greatly reduces your initial costs, as your primary investment is your time and effort in promoting the products.

3 Ease of Earning $100/Month

Rating: ★ ★ ★ ★ ☆

But, while setting things up may be relative cheap and quick, the real investment comes in content creation and audience building.

Successful affiliates spend considerable time crafting engaging and informative content to attract and retain an audience, so they can drive traffic to the links they’re promoting.

For example, let’s say you’re promoting a product worth $20 that pays a 5% commission — that means you’ll earn $1 for every purchase made through your link. To make $100 a month, then, you’d need to generate 100 sales.

But, if we take an average conversion rate of 1% – which is the percentage of people who actually buy the product after clicking the link – you’d need about 10,000 clicks on your link to make those 100 sales.

So, you can probably see why this is pretty tough to do because you not only need to generate a high volume of traffic but also ensure that it’s the right kind of traffic – people who are actually interested in purchasing what you’re promoting.

🤖 Automate a Business

The final passive income stream is building an automated business.

This involves setting up a business that runs with minimal ongoing intervention from you.

Think of a dropshipping store, where you simply manage the platform and customer interactions, while a third-party handles inventory and shipping. Or, you might develop a software product that users can download and use without needing constant updates or hands-on support from you.

One great example of someone who’s automated their business is Pat Flynn of Smart Passive Income. He’s systematised several aspects of his business, from content production to affiliate marketing, meaning he can earn passive income while focusing on the high-level strategy of the business and new ventures.

Another example is Oliur, who built a million dollar Shopify store selling a bunch of cool vegan leather products. While it took a fair amount of work to initially set up, he’s now got a team that manages most of the operation, which means he can focus on doing other stuff.

1 The Time Investment

Rating: ★ ★ ★ ★ ★

So, how much time does this all take to set up?

Well, setting up an automated business often requires a significant upfront time investment. You need to plan the business model, set up processes, and possibly develop software or other systems, so I’m going to give this a 5/5 rating.

2 The Financial Investment

Rating: ★ ★ ★ ★ ☆

The financial investment for an automated business, on the other hand, can vary greatly depending on the type of business. For example, setting up a dropshipping store might require less capital compared to developing a complex software product.

But, initial costs often also involve setup fees, software or platform costs, and potentially hiring staff or freelancers to manage operations or handle customer service, which can get quite expensive.

3 Ease of Earning $100/Month

Rating: ★ ★ ★ ★ ☆

And finally, how easy is it to start earning that first $100 per month?

Well, again, it isn’t the most straightforward thing to do, because you need to first build a product that’s decent, but you also have to put in the added effort of making things work well without much input from you.

So, I’m also going to rate this as a 4/5

So that just about wraps things up. Above you can see all the passive income streams and their ratings so you can compare them all.

But, it’s important to keep in mind that regardless of which one you choose, they’re definitely not get rich quick schemes that require zero time, energy or effort.

Having said that, if you’re patient and put in the work up front, there’s no reason you can’t start generating a pretty healthy amount of passive income without directly trading your time for money.